Bruc Bond recognizes the dynamic landscape of the banking industry in Singapore. With the increasing complexity of regulations and the growing demand for personalized customer experiences, banks are looking for innovative solutions to streamline operations and enhance efficiency. SaaS banking platforms have emerged as a powerful tool to address these challenges.

What is a SaaS Banking Platform?

A SaaS BankingPlatform is a cloud-based service that allows financial institutions to manage their operations digitally. Unlike traditional banking systems, which rely on on-premises infrastructure, SaaS platforms are hosted in the cloud, providing banks with the flexibility to access their services from anywhere in the world. This shift to cloud-based solutions is not just a trend; it’s a strategic move that offers several benefits, including cost reduction, increased operational efficiency, and improved customer experiences.

The Rise of SaaS in Singapore's Banking Sector

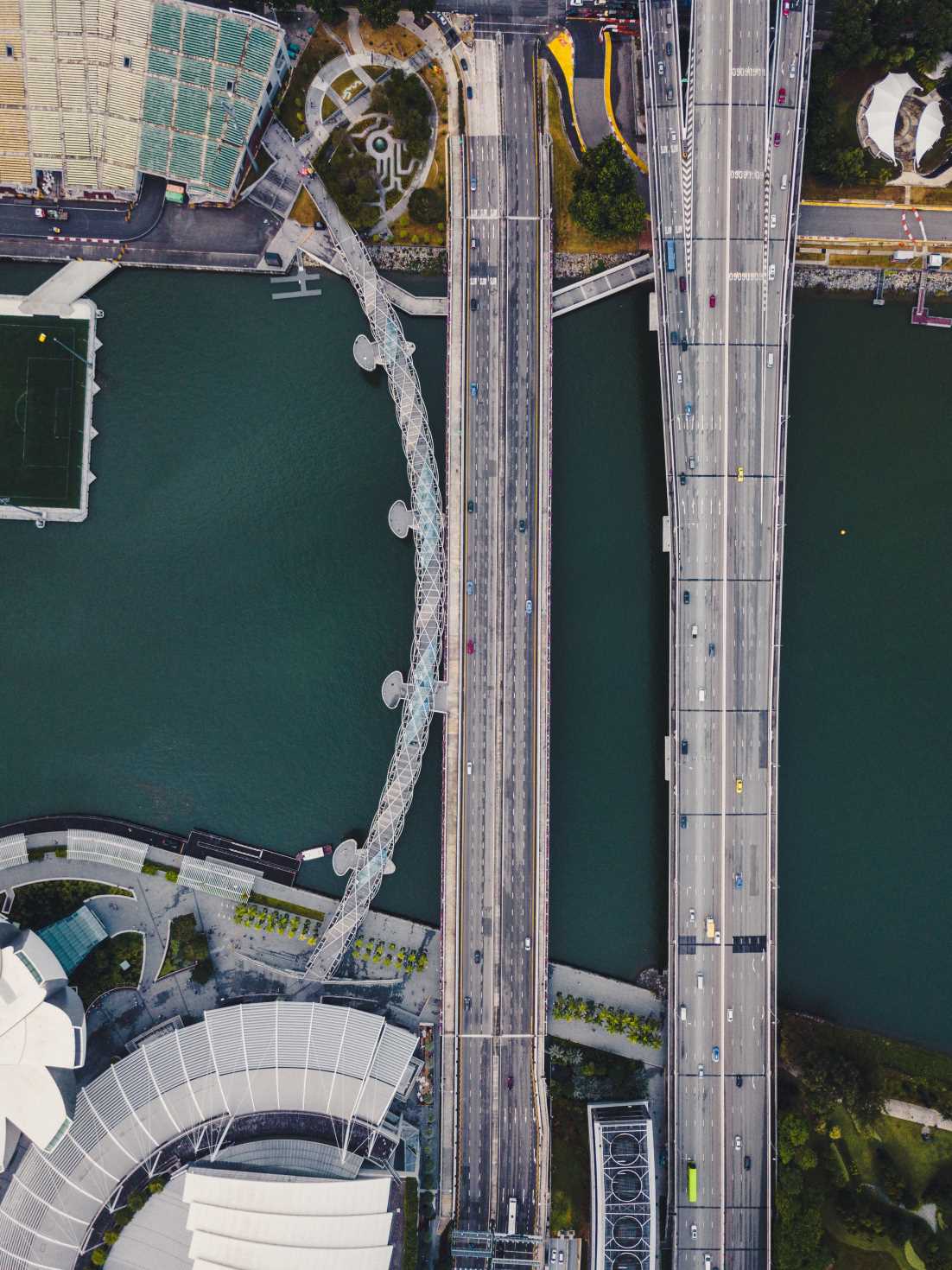

Singapore has always been at the forefront of financial innovation, and the adoption of SaaS platforms is no exception. The country's robust infrastructure, coupled with its progressive regulatory environment, makes it an ideal testing ground for new technologies. Banks in Singapore are increasingly turning to SaaS platforms to streamline their operations, reduce costs, and stay competitive in a rapidly changing market.

The Singaporean Banking Landscape and SaaS

Singapore has established itself as a global financial hub. Its robust economy and supportive regulatory environment have attracted numerous international banks. However, even with this strong foundation, banks in Singapore face increasing pressure to stay competitive. This is where SaaS banking platforms, a type of Global Banking Solution, can be a game-changer.

By adopting SaaS solutions, Singaporean banks can:

- Improving Operational Efficiency

By automating repetitive tasks like data entry and reconciliation, banks can significantly reduce manual errors. Streamlining processes such as loan approvals and account opening speeds up operations and frees up staff to focus on more strategic tasks. Ultimately, this leads to increased productivity and cost savings.

- Enhancing Customer Experience

SaaS platforms enable banks to offer tailored financial products and services based on individual customer needs. Faster transaction processing times, whether it's making a payment or transferring funds, improve customer satisfaction. Additionally, smooth digital interactions through mobile banking and online portals create a convenient and efficient banking experience.

- Strengthening Risk Management

SaaS platforms often come with built-in security features, helping banks protect sensitive customer data from cyber threats. Compliance with regulatory requirements is crucial for banks to avoid penalties and maintain trust. These platforms can assist in meeting regulatory obligations by providing tools for reporting and monitoring.

- Accelerating Innovation

SaaS platforms provide access to the latest technologies, allowing banks to quickly develop and launch new products and services. For example, banks can offer innovative mobile payment solutions or personalized investment advice. By staying at the forefront of technological advancements, banks can gain a competitive edge.

Core Banking and Beyond

Traditionally, core banking systems have been the backbone of banking operations. While they are essential, they often lack the flexibility and agility required in today's fast-paced environment. SaaS banking platforms offer a more comprehensive solution by extending beyond core banking to include areas such as:

-

Payments: Process transactions efficiently and securely, supporting various payment methods.

-

Lending: Automate loan origination, underwriting, and servicing.

-

Wealth management: Provide personalized investment advice and portfolio management.

-

Trade finance: Manage complex trade transactions and mitigate risks.

-

Customer relationship management (CRM): Build strong customer relationships through data-driven insights.

The Role of SaaS in Singapore FX Trading

Singapore is a major global FX trading hub. SaaS platforms can significantly benefit FX trading operations by:

Improving trade execution speed

-

Reduce latency: Latency refers to the time it takes for information to travel between systems. In the context of trading, it's the delay between placing an order and its execution. By reducing latency, you can significantly improve the speed at which trades are executed. This is crucial in fast-paced markets where milliseconds can make a difference.

-

Enhance order processing: Efficient order processing involves streamlining the steps involved in executing a trade. This includes tasks like order validation, routing, and matching. By optimizing these processes, you can reduce the time it takes to complete a trade, leading to faster execution and better fills.

Enhancing risk management

-

Monitor market fluctuations: Keeping a close eye on market movements is essential for managing risk. This involves tracking prices, volatility, and other relevant market indicators. By understanding how the market is behaving, you can identify potential risks and take appropriate actions.

-

Implement risk mitigation strategies: Risk mitigation involves putting measures in place to protect your investments from losses. This can include setting stop-loss orders, diversifying your portfolio, and using hedging techniques. By effectively managing risk, you can protect your capital and increase your chances of long-term success.

Providing advanced analytics

-

Gain insights into market trends: Advanced analytics tools can help you identify patterns and trends in the market. By analyzing historical data, you can make informed predictions about future market movements. This information can be invaluable for making investment decisions.

-

Understand customer behavior: Analyzing customer data can help you better understand their needs and preferences. By identifying customer segments and their trading patterns, you can tailor your products and services to meet their specific requirements. This can lead to increased customer satisfaction and loyalty.

SaaS and Singapore Private Banking

Private banking demands high levels of personalization and security. SaaS platforms can help Singaporean private banks by:

-

Offering tailored wealth management solutions: Create customized investment portfolios based on client preferences.

-

Strengthening client relationships: Provide exceptional customer service and build trust.

-

Ensuring data privacy and security: Protect sensitive client information with robust security measures.

Embracing the Future of Banking with SaaS

SaaS banking platforms are transforming the way banks operate in Singapore. By adopting these solutions, banks can improve efficiency, enhance customer experience, and stay ahead of the competition.

Bruc Bond understands the unique challenges faced by Singaporean banks. We offer a range of SaaS banking solutions tailored to meet your specific needs. Contact us today to learn more about how we can help you achieve your business goals.

By partnering with Bruc Bond, you can leverage the power of SaaS to drive innovation, optimize costs, and create a competitive advantage in the dynamic Singaporean banking market.